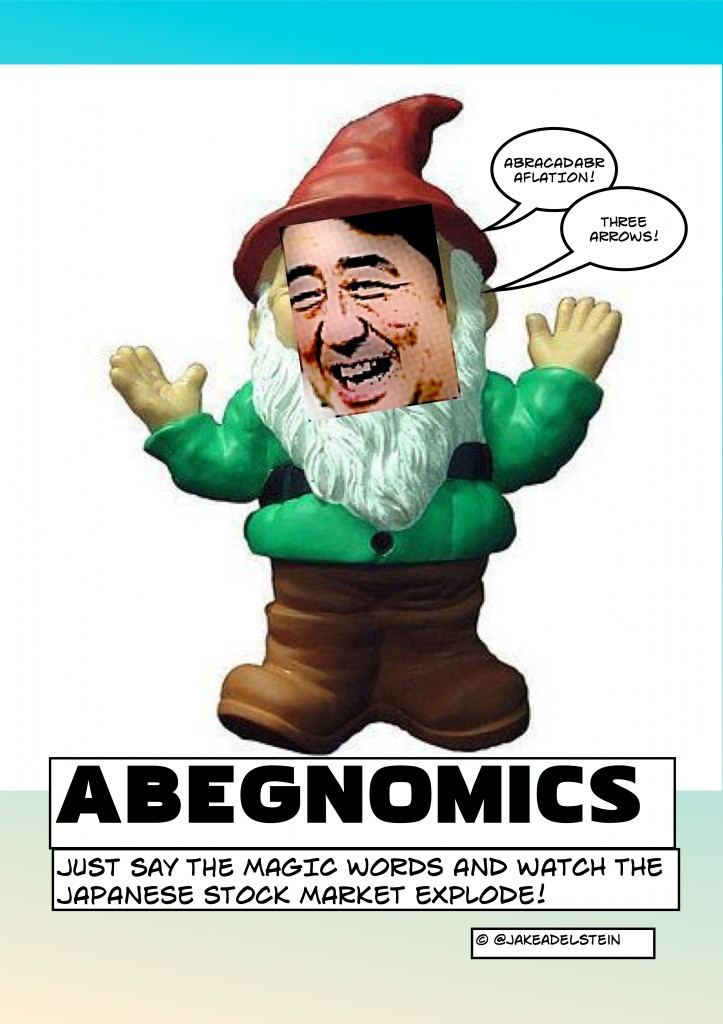

We’ll admit it. We just don’t understand Prime Minister Shinzo Abe’s much vaunted economic policy known as Abenomics. Spend public funds that Japan doesn’t have, increase inflation, but not raise minimum wages? How is this supposed to improve the economy? We know we’re missing something. Secretly, we feel like it only works because people believe it works. Sort of like fairies. If you believe in fairies, gnomes, and Abegnomics–than clap your hands! If you know how to explain, Abenomics–we welcome your article! And we’ll pay you top Abegnomic yen for it! (It’s imaginary but it will feel like a lot when you imagine you have it.) Contributions welcome.

[…] The Most Magical And Mysterious Economic Policy In The World! (Japan Subculture Research Center, June 7, […]

I don’t completely understand the totality of the Three Arrows strategy but the economic part is fairly straight forward. Japan’s economy benefited by strong exports. However, the Japanese Yen became too valuable and as a result, diminished profits (Price of their products overseas stay the same but can be converted into fewer yen) and increased costs (local labor costs relative to international labor costs) due to unfavorable exchange rates. On the other hand, it has given Japan the ability to invest overseas (which does not help the local Japanese job market).

By increasing inflation, Abe hopes to devalue the Yen to the point where Japan can export at more reasonable prices and bring down its costs relative to international standards. The main parties that are hurt at the companies and people who wish to spend yen overseas and import foreign products. Living in Vancouver, I can see the drop in Japanese students in this market.

Not increasing the minimum wage creates an image of being business friendly and does keep labor costs down. Their concerns seems to be more of the export market rather than the domestic market.

The part where you say it works because you secretly hope it does actually is one of the strategies. By boosting corporate and personal confidence in the economy, companies will take more risks in expanding, spending and developing as will people. It seems crazy but when done properly, it works. A good example of this is when Brazil created a new currency to replace the old one in order to curb hyper inflation. The currency itself meant nothing but what people thought of it meant the world.

I’m not saying I agree with any of this but at least someone is trying something.

That is the best explanation ever! Can I ask you to do a small rewrite of this explanation so I can post it as a separate article or if you’re busy can I elevate it up from comments into the body of the article? If so, how should I credit you.

Sorry. Haven’t checked back here until now. I’ll do a rewrite. Just let me know what you’re looking for. Send me a private message if that’s possible and we’ll communicate there. PS, it’ll be my first time. =)

Okay! If I space it out, write me back! Thank you.

Wha wha wha, well there goes that stock market boom to bust, here comes the inflation & there goes the bonds. Why the locals aren’t piling out of J-bonds & into well anything else shall remain yet another mystery of this land. The only theory is that between the eleite & the environment the locals are fatalistic about being fucked over on occasion.

You are exactly right. If you believe, then it must be real! (signal Disney music and a bunch of deer and butterflies frolicking around).

I watched a report on the news a few weeks ago, I think it was TV Asahi, and they said that because of Abenomics, people are spending tons of money on designer brands that they normally wouldn’t otherwise. They had interviews of people happily shopping at a watch shop in Ginza and all that.

The funny thing, though, is it may in fact be just what Japan needed. Not the overspending or inflation. I’m talking about the collective fiction that the economy is getting better. When I first arrived in Tokyo 15 years ago I remember people constantly talking about the bad economy, and they had news articles all the time about people saving on average a year’s pay in the bank(!), which was shocking to me.

But over the first few years here I got to know Japan more and it dawned on me: the real reason Japan couldn’t find a way out of the economic mess was simply because people believed the economy was down. That’s all. They saw reports of a weak economy on TV and horded money. I thought if only an important policy maker would just say the truth, that it wasn’t really that bad (which it wasn’t), then things would pick right up.

And now they finally have done that. The economy does seem to be picking up a bit simply because Abe said it would pick up.

Of course when the repercussions of his spending and all that hit it will probably end it all, but for now things seem positive.

We’re all clapping our hands for the time being. 😀

“The part where you say it works because you secretly hope it does actually is one of the strategies. By boosting corporate and personal confidence in the economy, companies will take more risks in expanding, spending and developing as will people.”

dawonga hit it right on the money. This is exactly the rhetoric I heard at my company on the first day of the new fiscal year when the president addressed the employees. It is almost as if a magic wand was raised, and all those jobs that clients were reluctant to send out were given the green light to go.

As was already pointed out, Abenomics seeks to improve Japan’s export economy. This is great news to companies like Toyota and Honda. I am not an economist, but the problem I see with this is that the big companies do not employ the majority of the Japanese public. In addition, many of these companies spent much of the two “lost decades” moving operations overseas to remain economically viable and competitive. As a result, the weak yen will help boost their profits overseas, but how much of that will actually trickle back to Japan is unknown. The Asahi Shinbun ran an article yesterday about how companies have been “hoarding” much of their profits to provide themselves with “extra insurance” just in case things awry. Supposedly they have ridiculous amounts of money, and Abenomics is looking to get them to use it. However, we have not seen any moves to raise wages that have fallen steadily since the burst of the bubble. Likewise, there is no guarantee that easing corporate taxes will encourage companies to raise wages (my company certainly is not). Thus, if the status quo remains as it is now, Japanese consumers are really going to feel the pinch in their wallets next year when the consumption tax is hiked to 8%.

If the euphoria that has accompanied Abenomics can be sustained and utilized to fuel economic growth, then all the power to it… But I still remain skeptical. Japan has other major issues to grapple with, such as the rapidly declining population (who are going to be paying progressively more for their pensions to support the Baby Boomer generation here). The cynic in me almost wants to say that Abenomics is meant to pull the public’s attention away from these very problems. I’m doing my best to keep the cynic in check.